We've joined our RTI Health Solutions colleagues under the RTI Health Solutions brand to offer an expanded set of research and consulting services.

Value-Based Payments: Is The CMS's Vision For 2030 Within Reach?

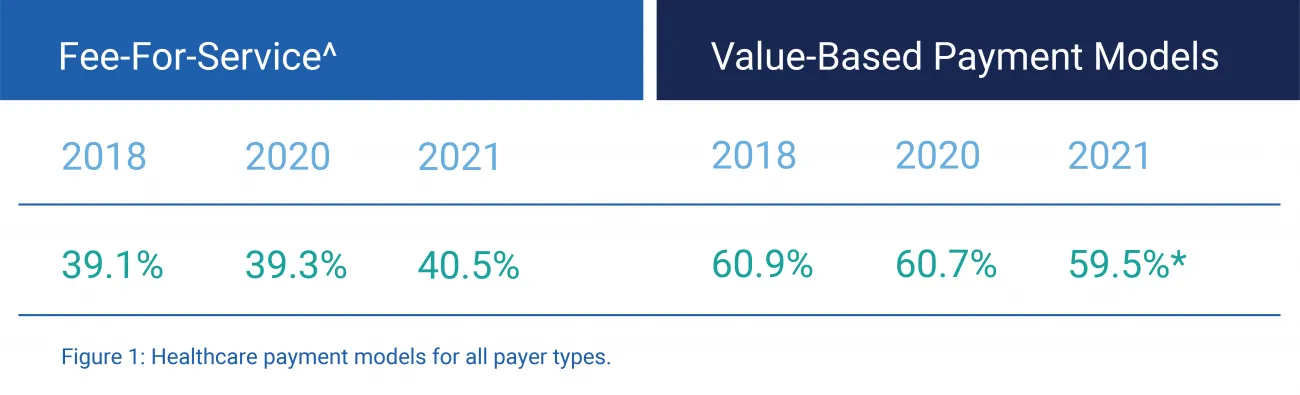

Value-based payment model adoption has been slow and steady, experiencing a slight decline in overall percentage of healthcare payments since 2018 (Figure 1). However, some areas of value-based payments have increased, and experts expect continued increases as the industry moves toward CMS's goal of 100% original Medicare beneficiaries and the majority of Medicaid in accountable care by 2030.

Figure 1: Healthcare payment models for all payer types.

^ Fee-for-service (FFS) represents payments not connected to quality or value. According to the Health Care Payment Learning and Action Network (HCP LAN), in 2021, *value-based payment participants included 63 commercial plans, five state Medicaid programs, and Medicare programs.

Value-based payment shifts in risk

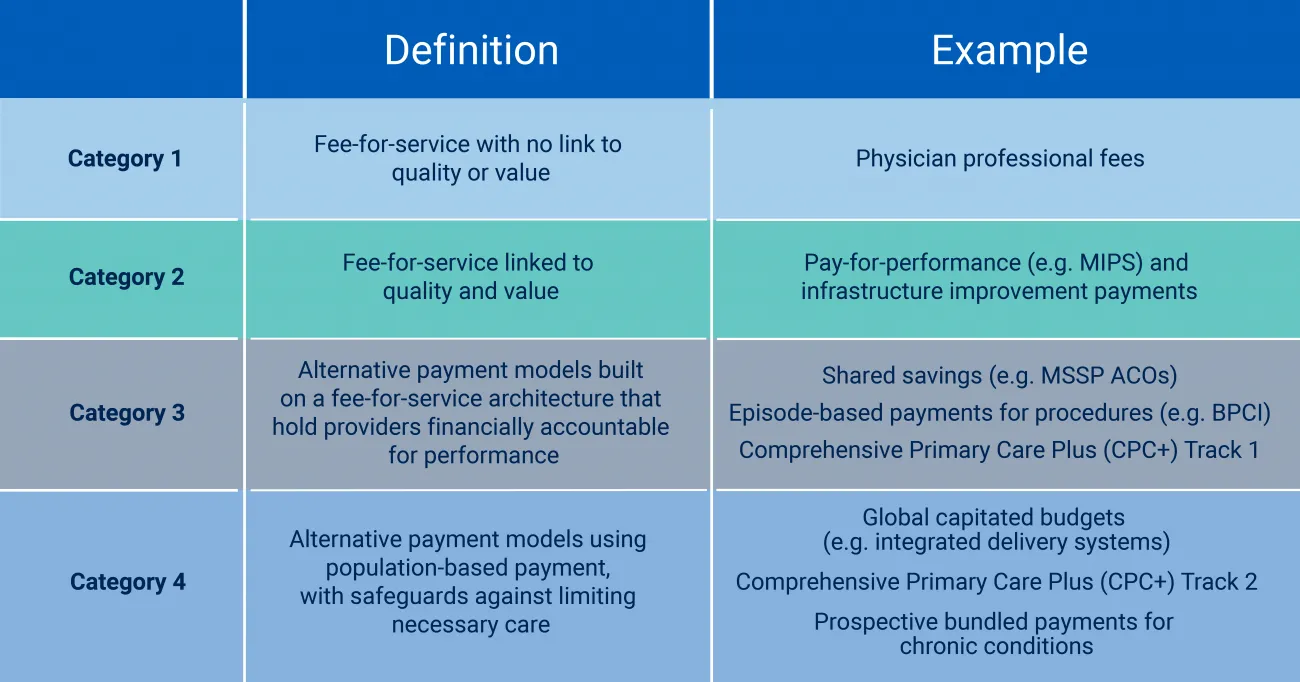

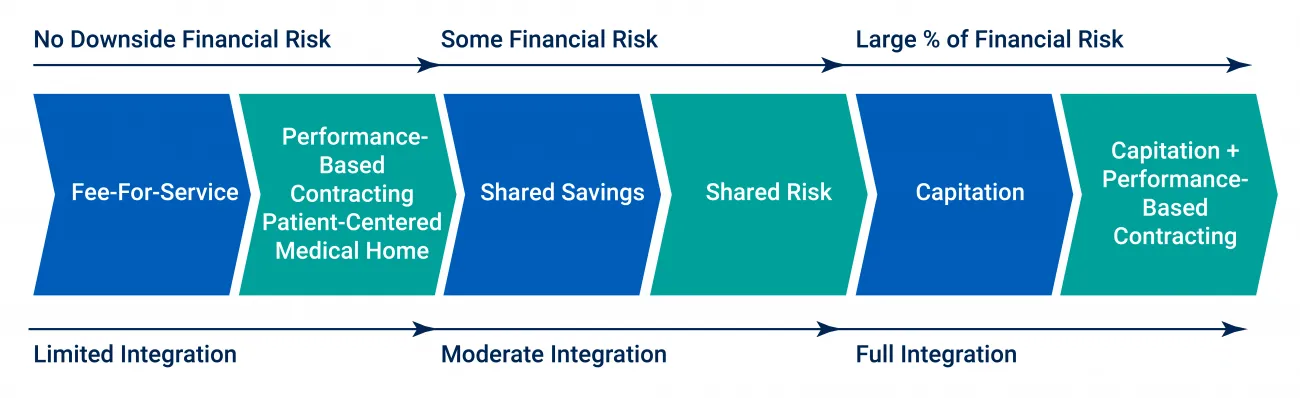

Value-based payment arrangements include numerous types, including those in Figure 2. Pay-for-performance incentivizes providers for achieving or beating cost and/or quality targets. Upside risk, also known as gainsharing, contracts shared savings but not losses. Downside risk arrangements disincentivize provider participants for going above cost thresholds or quality outcomes lower than specified targets. Full-risk arrangements, like capitated payments, require providers to take full responsibility for managing the total cost of care, quality, and outcomes for defined patient cohorts throughout the full care continuum.

Figure 2: Provider payment types. Source: HCP-LAN and Penn LDI.

Figure 3: Phases to transition from FFS to full-risk arrangements. Source: Penn LDI

Despite the pandemic's prolonged effect on providers, more healthcare payments flowed through downside risk via alternative payment models (APMs) in 2021 compared to 2020. These APMs included shared savings, bundled payments, and capitation contracts.

Medicare had the most downside risk contracts (24%) compared to commercial (12.7%) and Medicaid (16.6%) payers in 2021. Medicare Advantage grew by 6% to 35.2% of payments in upside or downside risk-based APMs. In 2021, commercial (53.7%) and Medicaid (52.3%) payers were still steeped in fee-for-service arrangements.

These shifts demonstrate where APMs are gaining traction and where more work to support value-based care adoption is needed.

CMS's 2030 goals: Transition to advanced value-based arrangements

As part of CMS's goals to improve patient health outcomes, they require providers to participate in value-based payment programs like the Merit-Based Incentive Payment System (MIPS) and the Hospital Readmissions Reduction Program.

In 2021, CMS established a goal to reach 100% of Original Medicare beneficiaries and the majority of Medicaid beneficiaries in some types of accountable, or value-based, care arrangement by 2030. And their goal is to transition 50% of its commercial and Medicaid contracts to value-based models by 2025; currently holding at 20%.

As the primary facilitator of CMS APMs, the Center for Medicare and Medicaid Innovation (CMMI) is in the process of updating their strategies and approaches, testing models and tools to improve adoption of value-based models.

Providers are at capacity but payers are “bullish" on value-based progress

Providers seem to be at capacity related to risk-based payments, particularly with the current financial challenges with labor shortages and higher costs. However, health plans are “bullish" according to some experts. Not a single payer participating in the APM Measurement Effort report said that their APM efforts would decrease. In fact, the survey that underpins the report found that 87% of payers in 2020 and 2019 said that their value-based activity would increase.

Challenges to value-based payment adoption

A 2021 University of Pennsylvania (Penn LDI) white paper, “The Future of Value-Based Payment: A Road Map to 2030" outlined five steps the CMS should take to increase advanced forms of value-based payment through alternative payment models. Their position is that achieving greater adoption requires a renewed and creative approach:

- Create a clear vision for the future of value-based payment across all publicly financed healthcare, driving change beyond Medicare and Medicaid.

- Dramatically simplify the current value-based payment landscape and engage late-adopting providers.

- Accelerate movement from upside-only shared savings to risk-bearing, population-based alternative payment models for participating health systems, curtailing providers' ability to opt out altogether.

- Pull providers toward advanced alternative payment models and structure incentives to move providers away from fee-for-service payment.

- Make health equity be a central feature and goal of value-based payment.

Lessons learned from a decade of value-based models

Payers, providers, states, and the federal government have a decade's worth of insights from value-based payment implementation. From that history, there are several lessons that require internalization to shift tactics and make value-based care work for everyone – providers, payers, populations, and individual patients.

- Administrative complexity within the value-based payment ecosystem is still a significant barrier. Support services and technologies will be needed to realize progress to greater levels of risk and reward.

- Fee-for-service is profitable for providers and it's what they know. Although the pandemic highlighted the downside of FFS, it remains the greatest motivator to remain.

- Transitioning upside risk-only to fully accountable care it a significant jump and many providers are challenged to operationalize programs, as well as weather the time and finances required.

- Value-based models must incorporate and address specialty care as part of the continuum of covered services. CMMI has made longitudinal accountable care that includes specialty access a focus.

- While a positive development, requiring a health equity plan as part of new value-based contracts with CMS creates a new hurdle for payers and providers.

Value-based models offer opportunities to partner

RTI Health Advance supports value-based model adoption from assessing the best model for a payer or provider to operationalizing risk-based care to implementing the data, population, and SDoH programs to provide high-quality accountable care. Contact us to discuss further.

Subscribe Now

Stay up-to-date on our latest thinking. Subscribe to receive blog updates via email.

By submitting this form, I consent to use of my personal information in accordance with the Privacy Policy.