We've joined our RTI Health Solutions colleagues under the RTI Health Solutions brand to offer an expanded set of research and consulting services.

Economic Stability Programs & Support - What's Working & Trending? SDoH Series, Part 2

How are programs and support initiatives moving the needle to improve health and quality of life across the 6 social determinants of health (SDoH)? In this article, the second in our series examining SDoH, we focus on economic stability to highlight the direct correlation between income and health. Article 1 focused on food insecurity.

Income inequality and the wealth gap are widening in the US

Amidst more people living in poverty and widening income inequity in the US and globally, we explore the current state of income instability, the effect of income on health, and walk through the major programs that are having a positive impact across numerous social risk factors, particularly health.

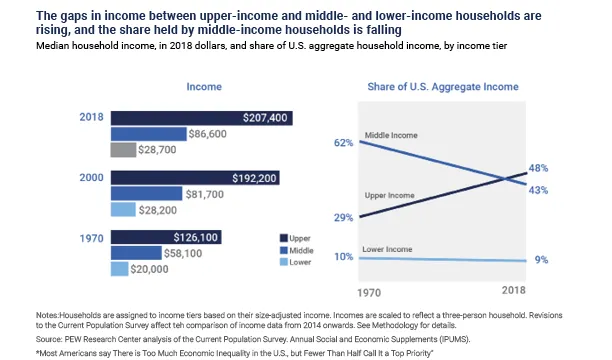

While poverty is a recognized contributor to higher mortality and disease, income inequality in the US has grown dramatically. As upper-income levels have increased considerably, middle-income has decreased significantly, and lower-income levels have nominally reduced. Figure 1 shows the gaps in income among US populations over time.

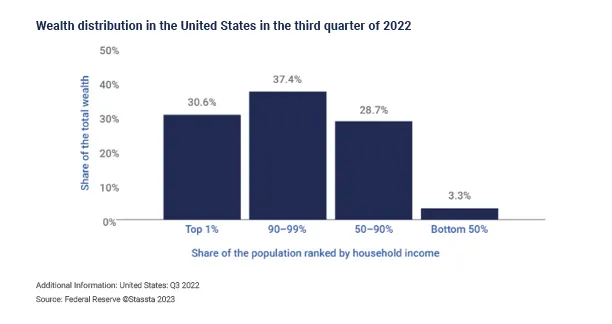

Figure 2 details the distribution of wealth in the US, indicating that half of the US population holds just 3.3% of all wealth. However, people with the lowest incomes aren’t the only ones experiencing income-linked health disparities when compared to the highest earners. Evidence suggests there are disparities among various low- and middle-class income levels, creating an income-health gradient.

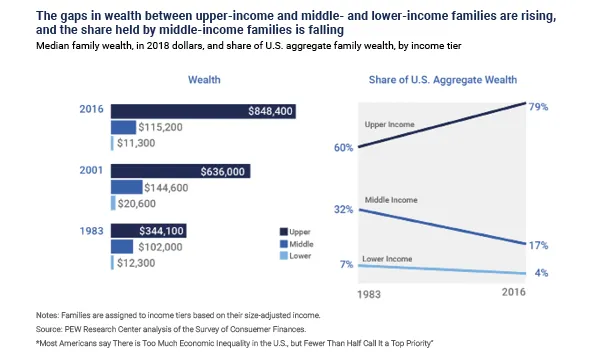

And, while income growth has resumed following the Great Recession, Figure 3 shows that the share of aggregate wealth in the US had been declining for 2 out of 3 income groups.

The largest source of US debt: unpaid medical bills affect 41% of adults

According to a nationwide 2022 KFF poll, more than 100 million people in America, including 41% of adults, have medical debt, totaling $140 billion. For 25% of those individuals, their debt is more than $5,000 and 20% don’t believe that they will ever be able to pay it off. This data is in comparison to Census Bureau data from 2019 that found 17% of households owed on a medical bill. This increase was exacerbated by the COVID-19 pandemic.

The KFF Health Care Debt Survey of 2,375 US adults reveals what people have had to sacrifice due to medical debt:

-

63% cut spending on food, clothing, and other basics

-

48% used up all or most savings

-

40% took on extra work

-

28% delayed buying a home or delayed education

-

24% sought aid from charity or nonprofit

-

19% changed living situation

-

17% declared bankruptcy or lost home

Plus, the disparity in medical debt reflects the impact of economic instability. Middle-aged adults and Black Americans are more likely to have significant medical debt. In 2019, 12% of medical debt holders were ages 50-64, compared to 6% ages 65-79. In addition, 16% were Black, compared to 9% of Whites. Women or individuals living with disabilities also share a higher percentage of medical debt. Increasing out-of-pocket costs like deductibles add to financial burdens for those with insurance.

What isn't surprising is that people with lower levels of self-reported health status and household income closer to the poverty level are associated with more medical debt.

The health-poverty link: the reinforcing cycle between lower income and poor health

Income level is strongly associated with morbidity and mortality across the income distribution. These income-related health disparities appear to be growing over time. Research found that, since 2001, life expectancy has increased by ~2.5 years for the top 5% of earners, but those earning in the lowest 5% saw no improvements. For example, men with incomes in the top 1% can expect to live 15 years longer than those in the bottom 1%, and women can expect a 10-year difference in life span.

This widening income-health inequity becomes apparent when considering that in the 1970s, a man aged 60 who earned in the top half of income in the US could expect to live 1.2 years longer than a man in the lower half. By the 2000s, the man earning in the top half of US income could expect to live 5.8 years longer than a man in the second half.

Other health-income correlations exist as well:

-

Adults living at or below the poverty level are 5 times more likely to report poor or fair health than those living with incomes above 400% of the federal poverty level.

-

Lower incomes are also correlated with increased rates of disability, heart disease, diabetes, stroke, and other chronic conditions.

-

Families earning less than $35,000 a year are 3 times more likely to smoke, 4 times more likely to report anxiety, and 5 times more likely to report feeling sad all or most of the time compared to those families earning more than $100,000 a year.

-

Low-income Americans experience higher rates of behavioral risk factors like obesity, substance use, and low levels of physical activity.

-

Most low-income workers do not have health insurance through their employers.

-

24% of adults with a household income of $35,000 or less did not have a usual source of healthcare compared to only 6% of families with incomes at or above $100,000.

In addition to the medical, physical, and mental effects of inadequate income, poverty and income instability lead to poor health and less capacity and capability to work, further reducing income and creating a negative feedback loop called the health-poverty trap.

Decreasing income instability positively affects health and well-being

Americans report that money issues are among the leading causes of stress, particularly for those living in the lower half of incomes. However, education and programs to address income instability have improved mental and physical health.

A JAMA Pediatrics article highlighted a study showing that a basic income for children “leads to better health,” influencing the “long-term effects of childhood family income supplements on mental health and overall functioning in adulthood.”

Another study found that participants who completed a financial education program set the stage for long-term and generational income, wealth, and health improvements. The persons completing the course benefitted financially but also adopted healthier behaviors:

-

Improved financial behaviors like using a written budget, saving money regularly, and paying bills on time

-

Reduced financial behaviors like borrowing money, maxing out credit cards, paying bills with late fees, and overdrawing bank accounts

-

Significantly increased salary and job promotion opportunities

-

Significantly reduced financial stress

-

Reduced tobacco use by 5%

-

Significantly reduced medical care skipped due to cost concerns

Income stability and financial initiatives and programs are positively impacting health and well-being. They set the stage for long-term and generational income, wealth, and health improvements.

Income maximization and financial literacy programs address income instability and medical debt

The following financial programs are primarily driven through federal policy, value-based payment contracts between CMS and payer-provider organizations, and community-based programs. They focus on tax credits, safety net programs, guaranteed income, and financial literacy.

Social programs reduce poverty

Research into programs that improve financial security through tax credits, cash transfers, and other safety-net programs has positively influenced health and well-being. Particularly impactful during childhood, reducing poverty has led to positive outcomes for low-income people, and those with mid-tier incomes who recently relocated.

Long-term impacts

The Moving to Opportunity program randomly assigned families who lived in high-poverty neighborhoods to receive vouchers that enabled them to move to low-poverty areas. Children under age 13, when they moved, realized average annual incomes in their 20s that were 31% higher than their peers who remained in high-poverty neighborhoods.

Safety net programs and tax credits

Considered one of the most extensive social welfare programs in the US, the Earned Income Tax Credit (EITC) provides direct financial assistance for low-income workers. The Temporary Assistance for Needy Families (TANF) program gives US states and territories flexibility with operating budgets to help low-income families with children improve economic self-sufficiency. TANF is a cash transfer program for underemployed or unemployed adults who are pregnant or have a dependent child. TANF differs from its predecessor program, Aid to Families with Dependent Children, as it is a time-limited benefit where beneficiaries can earn income and still be eligible.

Considerable evidence shows that safety-net programs like these improve health outcomes. Taking this tax credit is associated with reduced smoking among mothers, improved self-reported maternal mental health, as well as reductions in biological markers of stress. Research has shown that participating mothers have lower infant mortality and low-birth rates.

State programs to support consumers with medical debt

Financial assistance: The ACA required nonprofit hospitals to include financial assistance policies in their community benefit initiatives. Ten states now require hospitals to provide a wider array of free or discounted care for patients meeting certain eligibility criteria, including patient income. For example, Rhode Island requires nonprofit hospitals to provide free care to uninsured patients with incomes below 200% of the federal poverty level (FPL), mandating discounted care for people with incomes between 200% and 300% of the FPL%.

Debt collection: In 2021, over 13 states and DC enacted legislation regarding medical debt collections, limiting certain debt collection practices and avoiding collection unless specific conditions are met.

For example, New Mexico prohibited collection actions like lawsuits, liens on property, and wage garnishments for patients with incomes below 200% FPL. Nevada now requires that collection agencies send notices to debtors a minimum of 60 days prior to taking any collection action for unpaid medical bills.

Financial literacy and navigation support

The American Journal of Lifestyle Medicine published research on financial success programs (FSP) for single mothers living with low incomes. Nearly 350 women, ages 19-55, with incomes under 200% of the federal poverty level, received 9 weeks of financial education and coaching. Successful participants experienced significantly less financial strain, lower rates of smoking, and sought previously avoided medical care.

Guaranteed income programs

In recent years, cities have launched numerous guaranteed income programs predicated on the first city program in Stockton, California.

Stockton, California: Randomly selected residents in low-income neighborhoods received $500 a month for 2 years without any restrictions. Researchers found that regular payments stabilized family finances and encouraged increased full-time employment.

After a single year of participation, families experienced improved income stability from a 12% increase in full-time employment. During the program, 40% of participants had full-time jobs. Families also saw monthly earning fluctuations decrease by 20%, so their month-to-month income had become more stable. Guaranteed income recipients overwhelmingly used their money on food, utilities, transportation needs, and household goods, with less than 1% of income used towards tobacco or alcohol.

Following 4 years of the Stockton pilot, California became the first state to launch a universal basic income program in February 2023, providing over 12,000 residents $180 million in public and private funds.

Baltimore, Maryland: Baltimore's pilot focused on a population that suffered greatly during the pandemic. Young parents aged 18–24 living at or below 300% of the federal poverty level earn about $69,000 for a family of 3. Their Baltimore Young Families Success Fund chose 200 applicants drawn from a lottery and funded via the American Rescue Plan and private donors. Some participants planned to use funds for housing, as 14% were unhoused. Others had plans to improve work prospects, like attending flight attendant training or starting a new career.

Other city-based programs:

Outcomes from programs like Stockton Seed and Mississippi Magnolia Mother’s Trust showed a significant increase in participants who experienced greater income stability and relied less on borrowing from lenders, friends, or family members. Participants’ mental health and emotional well-being improved significantly, as well as their access to full-time employment.

Because of the focused geographical nature of these pilots, specific populations in need can be included in each pilot. Birmingham, Alabama focused on new mothers. Gainesville, Florida focused on formerly incarcerated individuals. Columbia, South Carolina focused on fathers. Of these programs, over 40% of recipients were Black, 33% were of mixed race, 25% were Latino, and 16% were White.

While more than 20 US cities launched a guaranteed or basic income program during the pandemic, over 100 guaranteed income programs were created in partnership with the Stanford Basic Income Lab, the Center for Guaranteed Income Research, or Mayors for a Guaranteed Income.

Addressing the health-poverty link

Through federal, state, and city policies and funding, health plans and health systems are launching or supporting innovative income and financial programs. Their efforts test strategies to determine what works best to improve economic stability. These initiatives have proven that shoring up economic stability can lead to improved health and well-being over the short-term, long-term, and even generationally.

Considering income stability programs? RTI Health Advance can help.

RTI Health Advance supports organizations at the forefront of healthcare. Our team of experts can offer guidance, strategies, and data analytics support, as well as social risk and SDoH screening tools that undergird any successful SDoH intervention. Meet our team and see our solutions in action. Contact us.

Subscribe Now

Stay up-to-date on our latest thinking. Subscribe to receive blog updates via email.

By submitting this form, I consent to use of my personal information in accordance with the Privacy Policy.