We've joined our RTI Health Solutions colleagues under the RTI Health Solutions brand to offer an expanded set of research and consulting services.

Employee benefits that help prevent, diagnose, and manage chronic illness

Self-insured employers are uniquely positioned to deliver high-quality healthcare, benefits tailored to the needs of their workforce, and bend the cost curve. Six strategies are helping self-funded employers achieve their own Triple Aim.

Over half of U.S. covered workers were in self-funded health plans in 2021

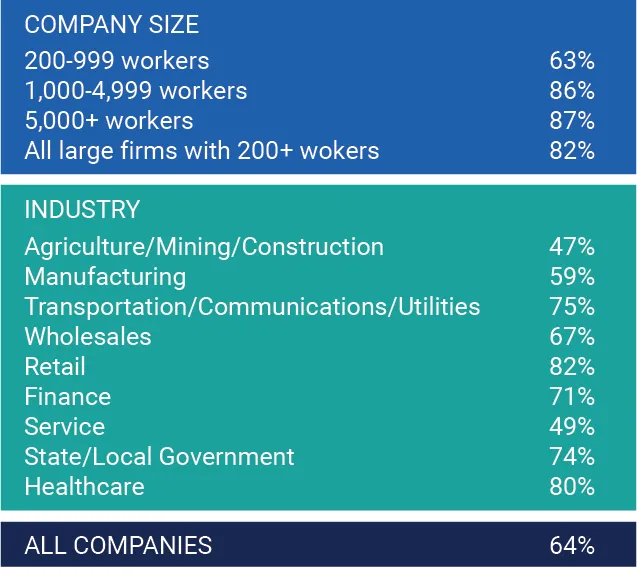

Self-insured employer plans are quite popular, considering that 64% of all covered workers in the U.S. were in a self-funded plan last year and that 82% of all U.S. companies with 200 employees or more chose self-funded models. According to the Kaiser Foundation, 71% of all self-funded employers are public, and 63% are privately owned. Figure 1 shows the percent of covered workers by employer size and industry.

Figure 1: Percent of covered workers in a self-funded plan.

Source: KFF 2021 Employer Health Benefits Survey

Chronic conditions are costliest for self-insured employers

While chronic health conditions tend to worsen or accumulate with age, the effect of chronic diseases on employers leads to not only skyrocketing costs but lower productivity, employees who are at work but not functioning at their best, and the opportunity cost of missed days at work.

For self-insured employers, 30-35% of all annual claims are driven by 1-2% of employees with costly chronic conditions. This is no small number when considering there are 151M working adults in the U.S., and a staggering 88% of those (133M) have a chronic condition.

Controlling chronic disease costs is employers' top priority

Not surprisingly, finding ways to mitigate the financial impact of chronic disease has become mission-critical for employers. In a recent Mercer survey, 80% of more than 2,500 responding employers (companies with 500 or more employees) said their top priority over the next five years was to monitor and manage high-cost claimants.

Six strategies for self-funded employers to help control chronic disease costs and support all employees

Self-funded employers are using or considering these six strategies to mitigate chronic disease costs and provide better overall benefits to all employees.

Pre-deductive coverage for chronic conditions

Since July 2019, the IRS has permitted employers to cover 14 specific treatments for chronic conditions outside of high-deductible health plan deductibles, if desired. Expanding pre-deductible coverage for chronic conditions makes care more accessible for employees and does not increase health plan premiums. Diabetes and heart disease were two chronic conditions most covered by employers. In 2021, 75% of large U.S. employers offering HSA-eligible health plans had expanded pre-deductible coverage for medications and services for chronic diseases.

Data analysis and predictive analytics to address rising risk of chronic conditions

Self-funded employers have the opportunity to use data analytics to address the near-term and future cost of employee healthcare by assessing which employees are at risk for developing chronic diseases. One study of four million members and 100+ million medical and pharmacy claims found that the healthcare costs for someone with rising risk for a chronic condition will cost more than an employee currently diagnosed. For example, the treatment costs for at-risk employees were 65% higher for chronic liver disease than for those already diagnosed.

Predictive analytics can project chronic diseases and treatment costs and help identify and engage rising-risk employees before their illness is diagnosed or becomes chronic. Using a tool like RTI Rarity™ supports risk identification by measuring and adjusting for behavioral and social factors that impact an employee's health. This data can help identify those most at risk for lifestyle-driven chronic disease and support targeted preventative interventions.

Third-party administrators that help in plan design

Third-party administrators (TPA) help manage company health insurance plans directly or through partnerships. While not a new strategy, TPAs are doing more to support self-insured employers' need to manage healthcare costs and attract top talent with tailored member benefits. Many larger companies have employees in most states, which is more prevalent since remote work grew during the pandemic. TPAs can identify disease management and wellness programs that benefit all employees and may be better suited for employees living with chronic illnesses.

Self-funded pharma plans

The pharmacy benefit represents 20-30% of most plan sponsors' healthcare costs. It's also the most utilized employee health benefit. Today, more employers who self-fund their medical plans are also considering self-funding their pharmacy benefits.

A study by Johns Hopkins found that self-insured employers that substituted prescription medications with less expensive options saved nine to 15% across all prescriptions. These employers were able to replace 95% of their formulary with clinically equivalent options. The cost of 30-day drugs declined by 53% for the first employer and 67% for the second.

Telemedicine and virtual-first health plans

The Society for Human Resource Management (SHRM) published their 2022 benefit report, saying that 93% of employers are offering telemedicine, up 20% since 2019. Their research found that 63% of employers provide most workers the opportunity to adopt a hybrid work model, making telemedicine benefits more appealing. More employers are contracting directly for telemedicine services; some include it as a pre-deductible benefit. Sixty-four percent of health plans surveyed said it would boost member satisfaction.

Self-insured employers are also beginning to adopt "virtual-first" health plans, with 15% of midsize and large employers offering a virtual-first option in the coming year and another 20% looking to add one soon.

An integrated approach to mental health - AEP isn't doing the job

About 70-80% of employees are experiencing mental health issues, which has increased from 80-120% since before the pandemic. While some say that employee assistance programs were inadequate to address mental health needs before COVID-19, self-insured employers are working to do more. Twenty percent of employers offer mental health days above and beyond regular sick leave.

Across all employer types, 91% offer mental health coverage, which was a new high in 2022. Creative ways to meet the personal behavioral health needs of employees and their families go a long way to support a healthy working culture and ensure that employees are engaged in all aspects of health before mental health conditions become chronic.

Risk-based contracts for self-funded employers

Eighty percent of healthcare organizations are also self-funded employers. More than 200 are provider-sponsored health plans (PSHP), offering regional employers a direct provider-payer option. Many of these health systems offer their employees their PSHP benefits. Additionally, some really large employers (5,000+ employees) – like Boeing and Microsoft – are entering risk-based contracts that go beyond self-funding but contracting directly with providers to manage and share risk. To do this effectively, employers or their TPAs will need to invest in population health capabilities and data analytics.

Advanced primary care

A systematic review of published research found that the "most promising efforts were those that lowered or eliminated cost sharing for primary care or medications for chronic illnesses." Integrating advanced primary care into existing benefits can help employees manage chronic conditions through risk-stratified care management, care navigation services, behavioral health integration, and evidence-based and shared decision-making.

Even commercial payers see the value of primary care benefits. One study found that 81% of payers believed that members would appreciate primary care visits becoming eligible for pre-deductible coverage.

One more cost-containment measure for self-funded employers: employer stop-loss (ESL) insurance

Employer stop-loss insurance isn't a direct cost-cutting measure. This type of insurance mitigates catastrophic loss by putting a cap on the amount that an employer would pay for an individual employee or aggregate claims over a deductible amount. However, around 85% of self-insured employers with less than 5,000 employees have stop-loss insurance, and 62% of all covered workers in self-funded health plans are in plans with stop-loss insurance. Larger employers are adding these policies, particularly since the pandemic started and because the future costs for long-term or "long-COVID" symptoms and chronic conditions caused by infection are yet unclear. Also, near-term costs to self-insured employers could increase as employees seek care that was delayed over the past two years.

Strategies to manage, diagnose, and prevent chronic conditions yield ROI

According to a RAND Corporation study, appropriately managing chronic diseases can lower healthcare costs for employers. PepsiCo, for example, offered a wellness program to help employees manage chronic illnesses. Their program saved $3.78 in healthcare costs for every $1 invested, demonstrating that chronic disease strategies can work and save cost.

RTI Health Advance is a consulting firm driven to deliver evidence-based, practical solutions for business, benefits, and organizational leaders that advance healthcare for everyone. Our experts can support self-insured employers create a cost-efficient and materially-effective employee program, including digital health, population health, data analytics, and health equity.

Learn more about RTI Health Advance and connect with us.

Subscribe Now

Stay up-to-date on our latest thinking. Subscribe to receive blog updates via email.

By submitting this form, I consent to use of my personal information in accordance with the Privacy Policy.