We've joined our RTI Health Solutions colleagues under the RTI Health Solutions brand to offer an expanded set of research and consulting services.

Retail has entered the healthcare space, and there's no turning back. What does this mean for health systems? Healthcare innovation includes retail and provider organizations that have an opportunity to lead their strategy or risk falling behind.

Several population, healthcare, and retail trends are converging. Health systems can investigate these shifts using SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis to determine if partnering with retail aligns with and accelerates their care, operational, and business objectives.

Health system-retail partnerships are accelerating

Retail giants like CVS, Amazon, Walmart, Best Buy, and Dollar General are leaping into healthcare like never before. Deals like those between Atrium Health and Best Buy or Kaiser Permanente and Target highlight the opportunity for health systems to leverage access, brand name, and technology to enable their innovative programs.

In Atrium Health's case, the partnership puts Best Buy in the position to deliver and set up their Current Health technologies as part of Atrium's hospital-at-home and telemedicine programs. This partnership diversifies Best Buy's product offerings with more services and provides greater access to people's homes. For Atrium, the collaboration gives them the brand name and operational backing to support home- and technology-based care models.

“Vertical integration is the name of the game," says Benjamin Maisano. He's a former health system technology chief who now leads a startup between Jefferson Health and General Catalyst. He adds, “…CVS and Walgreens are more accessible in the community and are ok with tighter margins."

Big box, pharmacy, and online retailers have been ramping up their entrée into healthcare for some time, seeing opportunities to fill care gaps while capturing greater market share. Still, through acquisitions and partnerships, both sides are capitalizing on several trends driving healthcare.

Trends driving health systems

There are a number of shifts that health systems are working through, the primary of which is their financial health. Hospitals and their health systems faced depressed margins, significantly elevated costs, and serious losses in 2022.

Solidifying revenue and expenses for the longer-term drives much of the M&A activity, particularly across struggling, smaller, or rural geographies.

Consumerism: Fueled by patients and employers paying more for healthcare, consumerism pushes provider organizations to think more like consumer-friendly retailers.

Aging US population: The burgeoning senior adult population is looming. Health systems are searching for ways to solidify their position and possibly gain a more significant share of the Medicare-Medicare Advantage markets.

VBC: Certainly, value-based care is shaking up the future of how provider organizations generate revenue, driving higher-quality care and more value for every healthcare dollar.

Care beyond the hospital: Virtual, digital health, and at-home technologies like telemedicine and remote patient monitoring are emerging as ways for providers to diversify revenue streams and respond to staffing shortages while trying to control costs and scale up access.

Health equity: Since the pandemic made health inequity glaringly apparent, health equity is becoming a regulatory and financial imperative, as well as a growing expectation of consumers.

Behavioral health: Retail is filling the behavioral health access void by bringing mental health counseling to convenient locations. CVS recently announced it will add these services to 6 of its MinuteClinics in Los Angeles, offering licensed mental health providers alongside virtual services.

These same trends attract retailers who see their strengths as having the potential to address healthcare's most persistent challenges, which is a momentous task.

Retail is responding to these same trends

Among retailers of all stripes—big box, pharmacies, and online—the priority is filling access gaps as they did during the pandemic. Retail health clinic utilization increased by 51% during the first year of the pandemic compared to 14% urgent care center utilization increase.

As Dr. Thomas Graham, Chief Innovation Officer at Kettering Health in Ohio, says, it's about “understanding the 'last mile' of care delivery." By providing more seamless and omnichannel digital-to-in-person experiences, as well as providing services in places where people already conduct much of their shopping, retailers are jumping into the fray with or without provider partnerships.

Consider this striking prediction from a recent report published by the American Hospital Association Center for Health. Nontraditional players—Amazon, CVS Health, Walgreens Boots Alliance, and Walmart—could own as much as 30% of the primary care market by 2030.

The AHA report underlines the market share that retail healthcare companies have seized in categories like primary care, concierge medicine, virtual care, and in-home services. Additional subcategories in their purview include pharmacy benefits management, behavioral health, and others.

Primary care: Urgent care was the start of it all with CVS's MinuteClinics and when Target sold their pharmacies to CVS Health because managing their in-house dispensaries didn't align with their core strengths. Today, filling the shortage of primary care providers is a vital aim for retail. Examples include Amazon's intended $3.9 billion purchase of One Medical, a primary care chain, and Walmart's expansion via 20 in-person clinic locations across 4 states. Also, the CVS-Signify and VillageMD-Summit Health deals play into a larger strategy where CVS wants to touch the entire spectrum of a person's health journey.

Nontraditional players—Amazon, CVS Health, Walgreens Boots Alliance, and Walmart—could own as much as 30% of the primary care market by 2030.

In-home care: The pandemic accelerated in-home care. Plus, digital health technologies like in-home diagnostics, including EKGs, blood pressure monitoring, and blood tests, set the stage for retailers to disrupt home care as well. Walgreen's purchase of home care company CareCentrix for $330 million and Best Buy's purchase of the care-at-home platform Current Health for $400 million indicate strong strategic moves in the space.

VBC: The types of companies that major retailers, including CVS and Walgreens have been acquiring, like Caravan Health, that CVS gained in buying Signify, are ramping up value-based care capabilities, such as data analytics and practice improvement solutions. These moves also put retailers in a position to move further into population health and VBC.

The bottom line is that retailers are creating access that solidifies their importance and position with consumers, which has traditionally been the foothold of provider organizations. The risk and opportunity this presents is one that health systems can weigh and assess. They will need to determine how retail is either a threat in their markets or a potential partner in which leveraging independent strengths to achieve synergies could raise both organizations' value and quality for consumers.

Taking a SWOT approach to retail-health system partnerships

Health system executives and strategic leaders might look at retail's moves as encroaching on what hospitals and health systems do best: to provide the entire continuum of care from birth to primary care, specialty care to home care. In many cases, retailers view geographical or access gaps as opportunities. Health systems, however, can leverage competition as a devised strength.

A SWOT approach helps leaders think through what they bring and what areas could use partnership support. SWOT analysis is a simple but powerful way to lay all the cards out on the table and get realistic about where and why to partner, as well as with whom.

Just like how hospitals integrated physician practices, post-acute care facilities, and ACOs to create health systems, those same systems can assess how partnering with retailers can accelerate and support care, business, and health equity objectives rather than simply pose a threat to market share.

Use a design-thinking brainstorming exercise to flesh out and prioritize the SWOT

Answering the following questions can reveal insights that can be used to uncover partnership prospects. If working with many leaders or stakeholders, consider using a digital or in-person brainstorming exercise with sticky notes during a strategy meeting to specifically discuss the impact and opportunity of retail on care, quality, finances, market share, and the organization's future.

Different colored sticky notes can be used for each area in the SWOT. Consider breaking it into 4 groups to create a starter set in each area if the group is significant. Then, bring the group together to work through and add ideas to each category. After pulling out all the concepts, get the group back up to rank order number their top 5 in each area. This exercise provides breadth, depth, and a democratic way of prioritizing.

Use these questions to kick-start the SWOT ideas by category

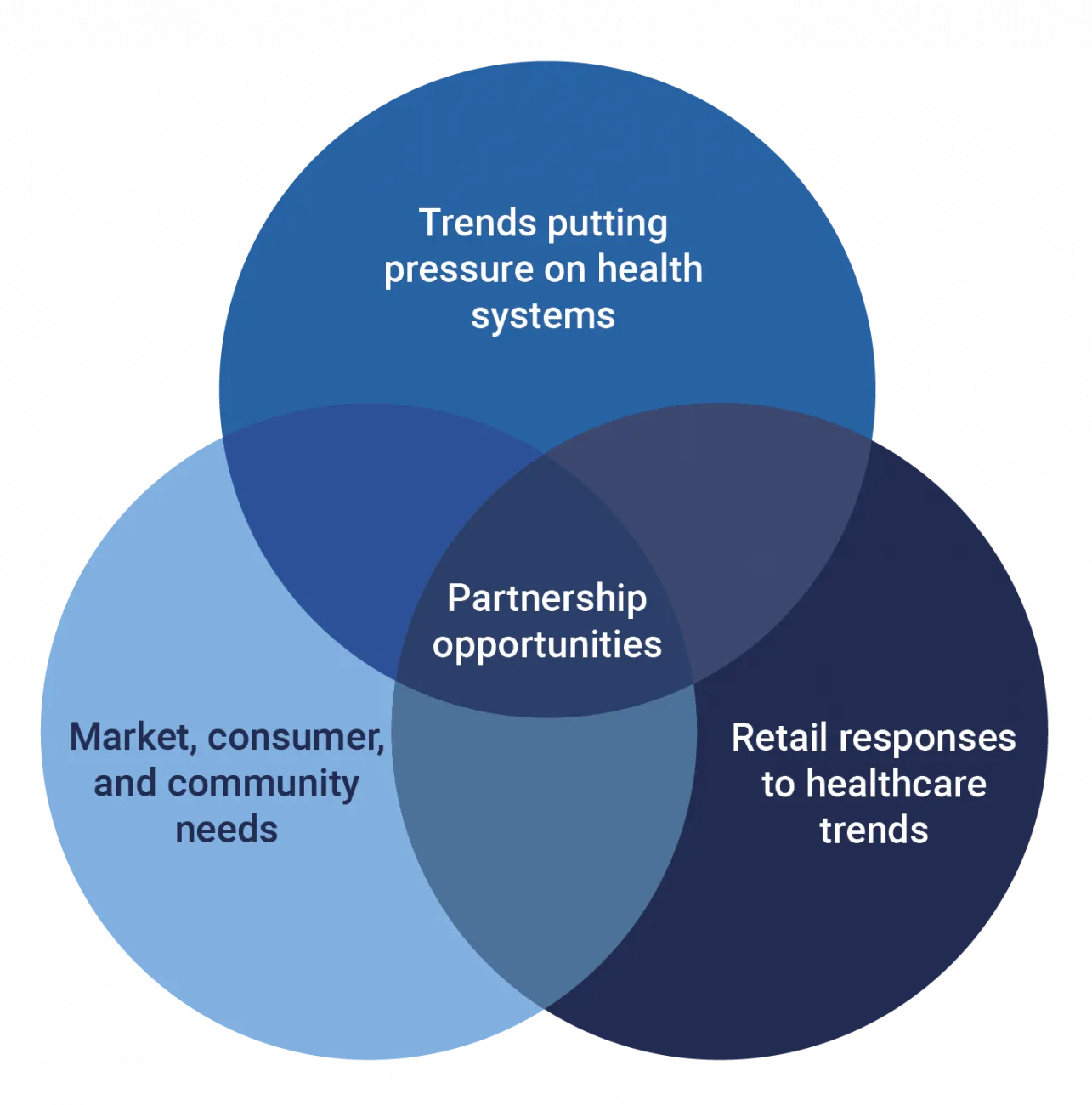

The Venn diagram in Figure 1 shows the sweet spot for partnering that a SWOT process can reveal. Use the following questions as a starting point.

Figure 1: Finding partnership opportunities by looking at health system and retail trends alongside market, consumer, and community needs.

Strengths

- What value, services, expertise, or other aspects of our organization can only be delivered by us?

- What have we learned from our past successes that have become strategic strengths?

- What did we learn about ourselves during the pandemic that we take forward as an improvement or new capability we didn't have before?

- Based on our latest strategic planning during or since the pandemic, what objectives are taking us into a stronger position that would make us an attractive partner?

- In the past 3-5 years, what were our most significant or more innovative “wins?"

- How are we partnering successfully? How have those partnerships become new strengths?

- When considering partners, what are their weaknesses or failures that we could fill, support, or replace?

Weaknesses

- Where have we missed the mark in the past?

- What areas are we clear that we should stay away from attempting?

- If we look honestly at ourselves, how have we done/are doing in digital, omnichannel, and consumer engagement?

- Are we engaged with our patients, community, and consumers, or have our digital inroads caused confusion and disjointed care or communication?

- How are we progressing related to issues like primary care shortages or trends like hospital-at-home?

- When considering partners, what are their strengths that could fill, support, or replace 1 or more of our weaknesses?

Opportunities

- What are our quality, care, or financial goals that could be furthered or accelerated through retail partnership? For example, would a partner help us go deeper with value-based contracting, digital health, or Medicaid innovation waivers?

- What trends do we know our communities and consumers want or align with our goals?

- How could partnering with retail enhance our access points, community connections, and brand?

- When considering partners, whom have they partnered with in the past that are similar to us? How did that partnership fare?

Threats

- Do we know how retail has already impacted our organization?

- What services and revenue streams have been impacted?

- How close are we to our patients and consumers…those who love and dislike us?

- When considering partners, which retailers need us more than we need them or vice versa?

Capitalizing on strengths to achieve care, quality, and business objectives

Each health system and retailer bring particular strengths and weaknesses to the table. Being aware of both on each side provides a foundation for fruitful partnerships. Health systems must decide to create a proactive strategy based on their SWOT and priorities or end up losing market share, consumer loyalty, and their community foothold.

RTI Health Advance aligns health system and retail goals for mutual success

Our team comprises clinical, health policy, population health, digital therapeutics, data science, quality, and health equity experts. Together, we deliver evidence-based, practical insights and solutions for clinical, business, and programmatic leaders to achieve their most pressing care, quality, and financial objectives. Contact us.

Subscribe Now

Stay up-to-date on our latest thinking. Subscribe to receive blog updates via email.

By submitting this form, I consent to use of my personal information in accordance with the Privacy Policy.